nj property tax relief fund 2020

Capital gains and the exclusion of all or part of the gain on the sale of a principal residence are calculated in the same manner for. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader.

2020 Nj Senior Freeze Property Tax Reimbursement Applications Clayton Nj

How can I lower my property taxes in NJ.

. John Reitmeyer Budgetfinance writer September 6 2020 Budget. The main reasons behind the steep rates are high property values and education costs. For Immediate ReleaseApril 15 2020.

Senior Freeze Property Tax Reimbursement Program. More than 53000 peacetime veterans will become newly eligible for a 250 property tax deduction in keeping with a 2020 voter referendum. Property Tax Relief Programs Homestead Benefit.

Introduced - Dead 2020-01-30 - Introduced in the Senate Referred to Senate Budget and Appropriations Committee S986 Detail Download. Here are the programs that can help you lower property taxes in NJ. In New Jersey localities can give.

Forms are sent out by the State in late Februaryearly March. County and municipal expenses. Evan Dvorkin via Unsplash.

Property Tax Relief Programs. 100 disabled veteran property tax exemption. For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms.

Capital gains in excess of the allowable exclusion must be included in income. If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception. Out of State Residents.

But those with high tax bills see a benefit. Call NJPIES Call Center. Besides education property taxes in NJ also fund.

In 2021 the average New Jersey property tax bill was about 9300. Establishes surplus revenue reserve account in the Property Tax Relief Fund if certain levels of unanticipated gross income tax revenue are collected. Call the Senior Freeze Information Line at 1-800-882-6597 for more information.

Only honorably discharged wartime veterans have been. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019. Programs for low-income residents seniors disabled again may lose.

COVID-19 is still active. Stay up to date on vaccine information. Renters can qualify for like 50 of property tax relief.

Property taxes and other expenses. We will begin mailing 2021 applications in early March 2022. NJ Veterans Property Tax Exemption.

So any personal income tax refunds come out of the Property Tax Relief Fund. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. 142 million in Homestead property tax credits 71 million in college operating aid 45 million in.

09 2020 5 New Jersey homeowners will not receive Homestead property tax credits on their Nov. You are eligible for a property tax deduction or a property tax credit only if. 250 veteran property tax deduction.

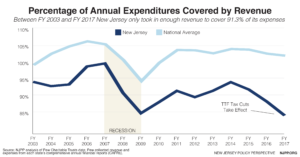

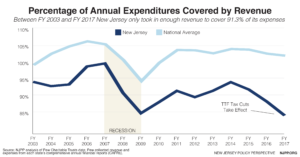

Fiscal year-to-date total collections of 22398 billion are up 13 billion or 62 percent above the same period last year. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence main home. If its approved by fellow Democrats who.

For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did. To qualify you must meet all the eligibility requirements for each year from the base. So any personal income tax refunds come out of the Property Tax Relief Fund.

The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax Foundation. Phil Murphys latest budget calls for flat or even reduced state funding for popular property-tax relief programs that provide targeted. In New Jersey localities can give.

The effects of the spending freeze will be far-reaching and include. 18 of your rent is used to calculate your share of property tax Per the state constitution Article VIII Section I paragraph 7 100 of personal income tax goes to property tax relief. Nearly 18 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov.

Partisan Bill Democrat 1-0 Status. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year. Phil Murphy unveiled Thursday.

TRENTON - The Department of the Treasury today reported that March revenue collections for the major taxes totaled 1888 billion up 663 million or 36 percent above last March. For a middle-class family getting that 1500 in direct relief that. Letter of Ineligibility for.

Forms are sent out by the State in late Februaryearly March. Phil Murphy s proposed 324 billion spending plan includes 275 million for the property tax relief program which lowers tax bills. Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property taxes or through rent.

Capital gains on the sale of a principal residence of up to 250000 if single and up to 500000 if marriedcivil union couple. NJ Division of Taxation - Local Property Tax Relief Programs. The up to 35000 payment would come in the form of a three-year forgivable loan which would.

Murphy Legislative Leadership Announce Deal On Anchor Tax Relief Plan New Jersey Globe

Tax Relief Suddenly At Top Of Agenda In N J As Money Pours In Like Never Before Nj Com

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

500 Tax Rebate Available For Eligible New Jersey Residents

Jersey City Taxpayers Face One Two Punch In Tax Hikes As Council Set To Introduce 695 Million Municipal Budget Nj Com

New Jersey Retirement Tax Friendliness Smartasset

2021 Property Tax Relief Application Senior Freeze Now Available Borough News Borough Of Glen Rock New Jersey

N J S Federal Stimulus Funds Will Have Few Strings Attached Biden Administration Says Nj Com

Murphy Enhances Proposed Anchor Property Tax Relief Program New Jersey Business Magazine

Tax Collector Woodland Park Nj

Nj Governor Leaders Agree On 2b In Property Tax Relief Tri City Herald

What Will N J Do With All Those Extra Billions Pouring In Some Push Tax Breaks Nj Com

Nj Announces Tax Payment Delays For Ida Victims New Providence

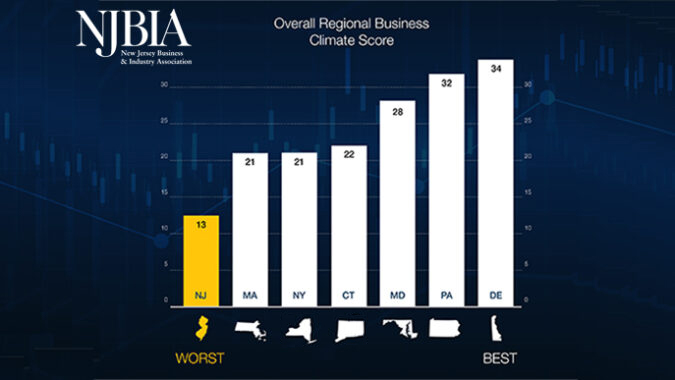

Njbia 2022 Business Climate Analysis Shows Nj Still Worst In Region Njbia

Dems Redistricting Map Gets Nod From Commission Nj Spotlight News

New N J Budget A Look Behind The Numbers Of 50 6b Spending Proposal Whyy

Nj Property Taxes Have Been Rising At A Slower Pace Nj Spotlight News

Ending Delays For Senior Freeze Beneficiaries Nj Spotlight News

Three Ways To Cast A Vote In Nj S Primaries Nj Spotlight News